Nvidia's Unprecedented Rise

Nvidia has recently achieved a major milestone by surpassing Apple to become the second-most valuable company in the world, crossing an astonishing market capitalization of $3 trillion. This historic achievement underscores Nvidia's significant impact on the tech industry, particularly through its advancements in artificial intelligence (AI).

The company's market capitalization reached nearly $3.02 trillion, outpacing Apple's $2.99 trillion valuation. This places Nvidia just behind Microsoft, which maintains its position as the world's most valuable company with a market capitalization of approximately $3.15 trillion. The achievement marks a significant leap from Nvidia's earlier milestones, including reaching a $1 trillion valuation last year and briefly hitting $2 trillion earlier this year.

AI Revolution: The Driving Force

Nvidia's meteoric rise can be attributed to its strategic focus on AI chips, which have become the backbone of the hardware powering today's leading generative AI developers. Among these groundbreaking products is the H100 chip, widely recognized for its superior performance in AI applications. This focus on AI technology has enabled Nvidia to report record-breaking revenues and solidify its role as a leader in the global AI rush.

In its recent quarterly earnings report, Nvidia stated it had achieved a record revenue of $26 billion, marking an 18% increase over the previous quarter and a remarkable 262% increase compared to the same period last year. Alongside this revenue surge, net income also saw a substantial rise, jumping from $2 billion to nearly $15 billion, highlighting the company's robust profitability.

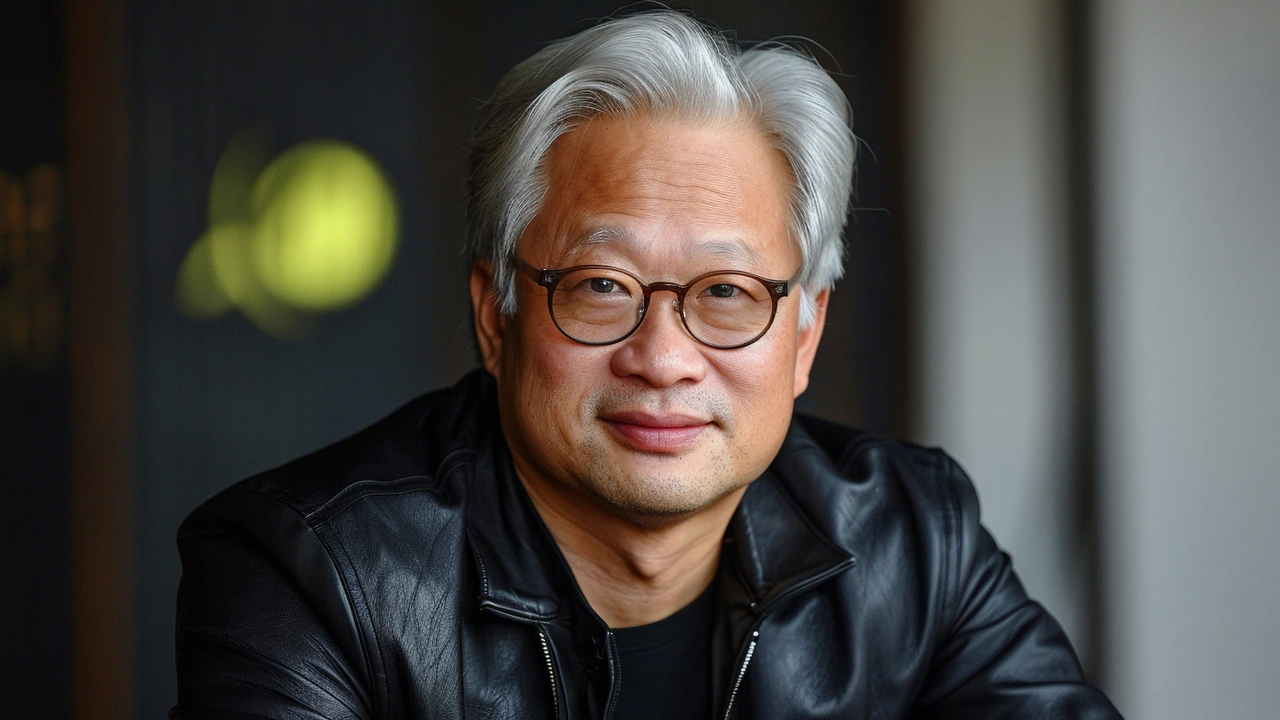

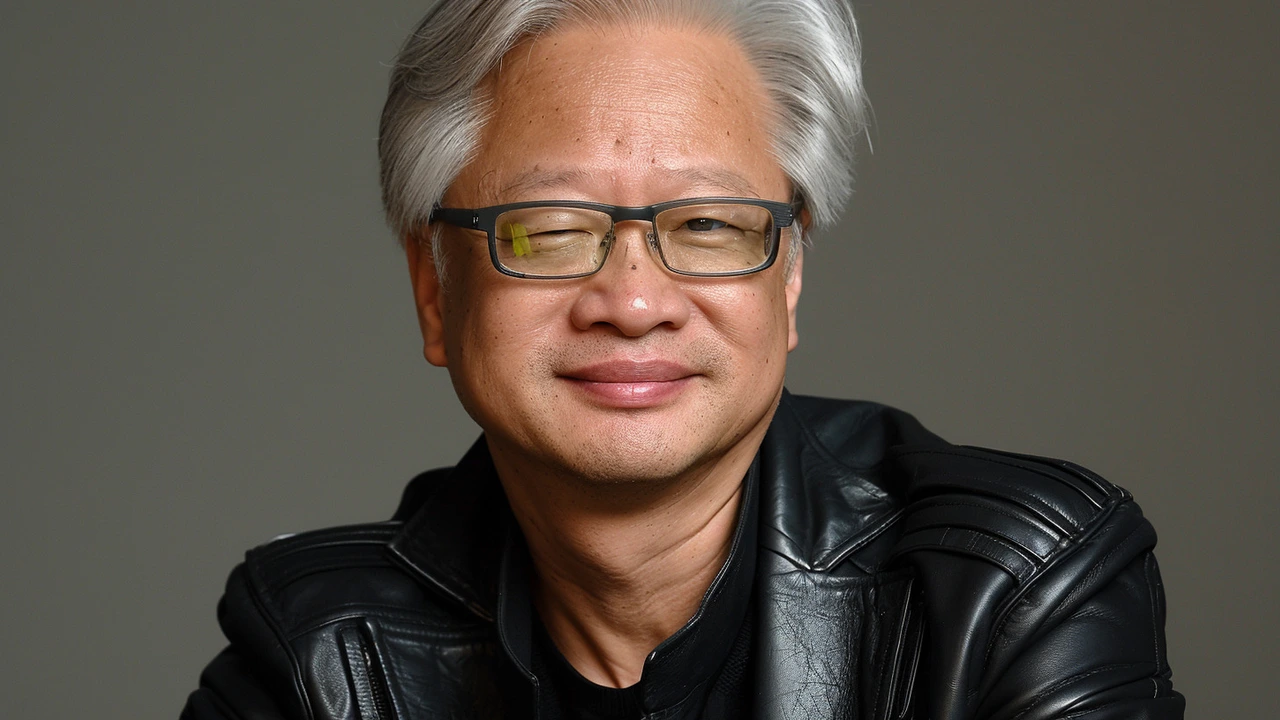

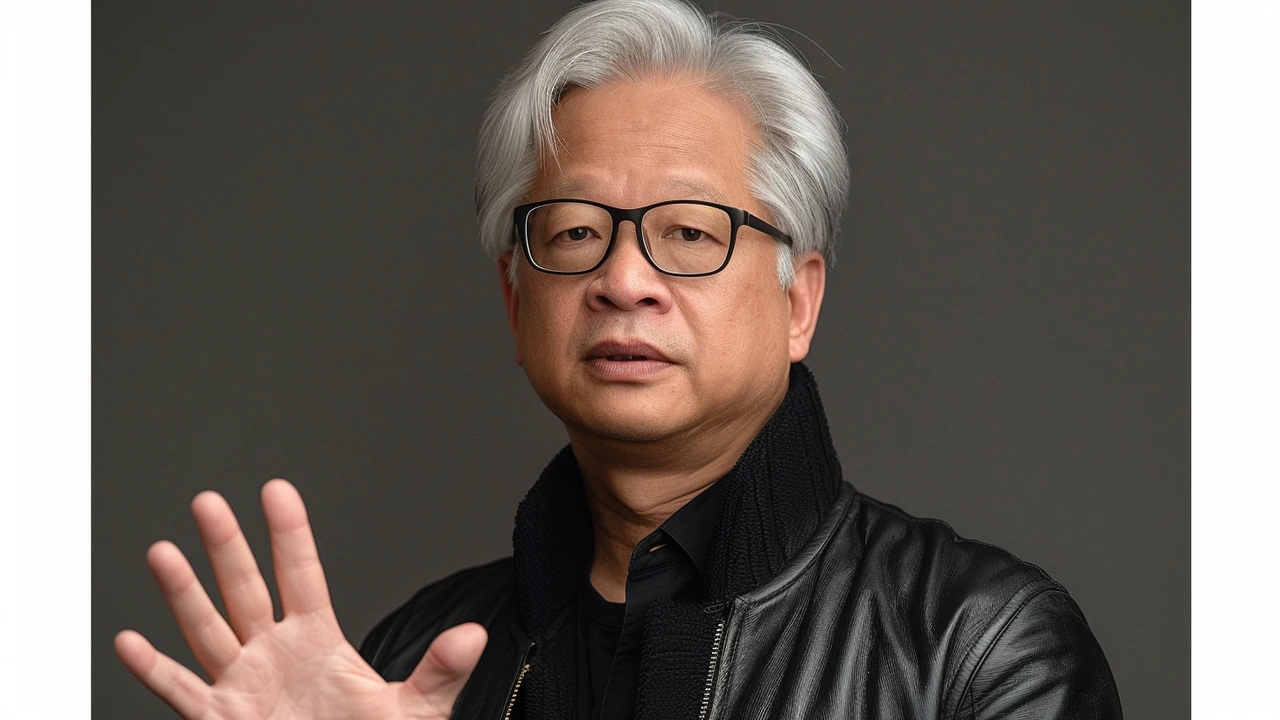

CEO Jensen Huang's Vision

Nvidia's CEO and founder, Jensen Huang, played a pivotal role in steering the company towards its current success. Huang has consistently been a vocal advocate for the transformative potential of AI across various industries. He emphasizes that AI will bring unprecedented productivity gains and cost-efficiency, reshaping the future of technology and business.

Under Huang's leadership, Nvidia has not only developed powerful AI chips but also ventured into innovative product lines. Recently, the company unveiled its Blackwell products, poised to succeed its current AI chip models. These new products are expected to further cement Nvidia's grip on the market and continue driving its exponential growth.

Challenges and Legal Hurdles

Despite its tremendous success, Nvidia has faced its share of challenges. The company has encountered legal issues related to the use of copyrighted material in training its AI models. This adds a layer of complexity to its operations and highlights the broader industry-wide concerns regarding ethical and legal aspects of AI development.

The issue of copyright infringement in AI model training remains a contentious topic, stirring debates within the tech community and beyond. Nvidia's approach to navigating these challenges will be critical in shaping its future trajectory and maintaining its leadership position.

A Glimpse into the Future

Looking ahead, Nvidia's achievements serve as a testament to the transformative power of AI technology. As the AI revolution continues to unfold, companies like Nvidia are at the forefront, driving innovation and setting new benchmarks. The company's rapid ascent and sustained growth underscore the increasing importance of AI in shaping the future of the tech industry.

With a strong foundation, a visionary leader in Jensen Huang, and a portfolio of cutting-edge AI products, Nvidia is well-positioned to continue its upward trajectory. As it charts the course for future advancements, the tech world will be keenly watching Nvidia's next moves, poised to witness more groundbreaking milestones in the years to come.

The tech landscape is in a state of constant flux, and Nvidia's ability to adapt and innovate will be crucial in maintaining its competitive edge. The company's focus on AI not only highlights the current trends but also sets the stage for future developments, making Nvidia a key player in the ongoing tech evolution.

The story of Nvidia's rise is one of strategic vision, technological innovation, and relentless pursuit of excellence. As the second-most valuable company in the world, Nvidia's journey serves as an inspiration and a blueprint for future tech enterprises aiming to make their mark in the ever-evolving digital age.

Paul KEIL

June 6, 2024 AT 17:50Nvidia's $3T cap is the inevitable outcome of their strategic AI chip dominance. H100's compute density has become the de facto standard for enterprise AI infrastructure, leaving Apple's mobile-centric strategy in the dust. The market's recognition of this structural advantage is why they've surpassed Apple in valuation. Apple's ecosystem simply can't compete with the raw computational power Nvidia provides to AI developers. This isn't a temporary surge-it's a fundamental shift in tech industry value creation. The $26B quarterly revenue and $15B net income are just the beginning of what's possible with their AI moat.

Horace Wormely

July 8, 2024 AT 05:50Nvidia's market capitalization has surpassed Apple's, but the article incorrectly states '3 trillion' when the current valuation is $3.02 trillion. Financial accuracy is essential in reporting such significant figures.

christine mae cotejo

August 8, 2024 AT 17:50Oh my absolute goodness, this is the most incredible tech story of our generation! Nvidia's journey from a niche GPU manufacturer to the second most valuable company globally is nothing short of awe-inspiring. The H100 chip has single-handedly revolutionized AI training infrastructure, making what was once computationally impossible now routine. Jensen Huang's vision back in 2016 when he bet everything on AI infrastructure has paid off in ways he probably couldn't have imagined. I've been following their quarterly reports since 2020, and the consistent 200%+ YoY revenue growth is simply staggering. The fact that they're now generating $15 billion in net income quarterly while Apple struggles with stagnant iPhone sales speaks volumes about the paradigm shift. Their strategic pivot from gaming to AI wasn't just smart-it was visionary. The Blackwell architecture rollout next quarter will likely accelerate this trajectory even further. Let's not forget how this impacts every single tech company, from startups using their chips to giants like Google and Microsoft building AI services on top of Nvidia's platform. The copyright lawsuits they're facing? Honestly, that's a tiny speed bump in the grand scheme of things. The real story here is how Nvidia has created an entire ecosystem around AI compute. They're not just selling hardware; they're building the foundation of the AI era. The market's valuation isn't just about current profits-it's pricing in the next decade of technological evolution. I've seen countless companies fail to adapt to major industry shifts, but Nvidia has done it perfectly. This isn't a bubble; it's a fundamental restructuring of how technology operates. I'm genuinely excited to see what they'll unveil at GTC next year, but honestly, the H100 has already changed everything. The sheer scale of their market capitalization now-$3.02 trillion-is a testament to how deeply AI has penetrated our economy.

Douglas Gnesda

September 9, 2024 AT 05:50Nvidia's H100 demand is straining their supply chain, but their manufacturing partnerships with TSMC and Samsung seem to be holding up. The Blackwell architecture's power efficiency appears superior to H100 for large-scale AI deployments, which could drive further market dominance. The 262% revenue growth is impressive, but long-term sustainability will depend on their ability to maintain this pace amid rising competition.

Abhijit Pimpale

October 10, 2024 AT 17:50Apple's market cap decline is inevitable. Nvidia's AI dominance is structural.